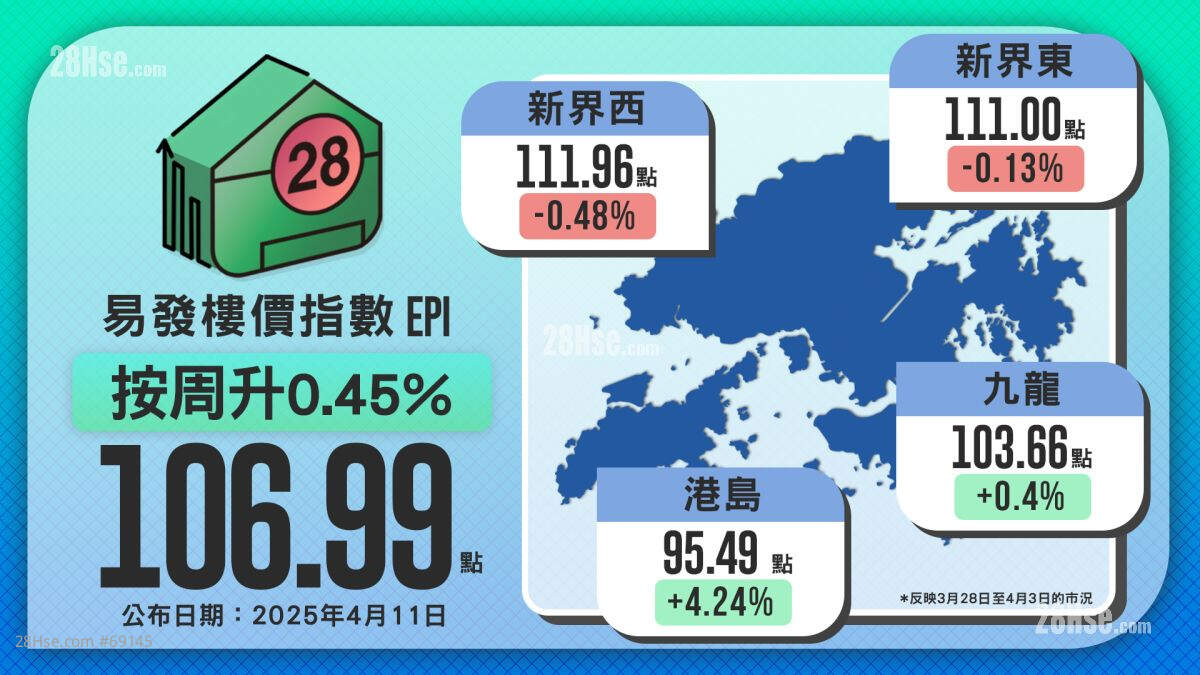

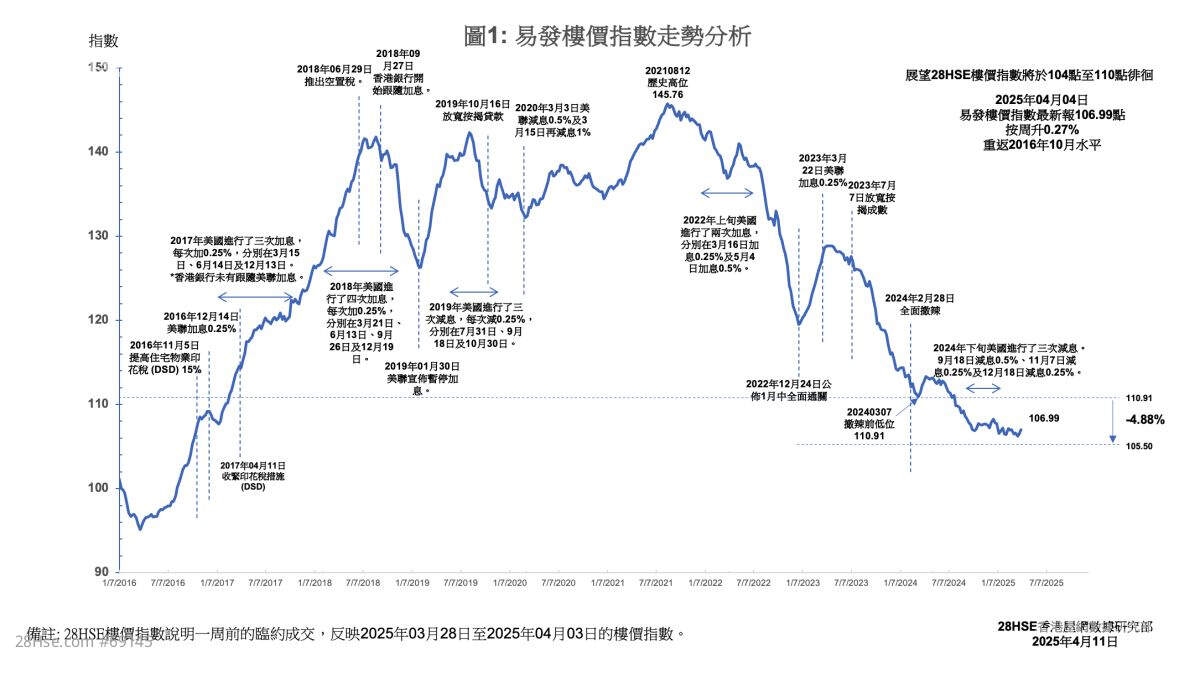

Amid a slowdown in new property launches, the secondary market has enjoyed a brief respite. This week, the Eva Property Price Index reached 106.99 points, up 0.45% week-on-week. However, the imposition of tariffs by the United States on multiple countries has heightened global geopolitical tensions, further destabilizing the outlook for Hong Kong’s real estate market. In the short term, property prices are expected to remain under pressure. Market attention is now focused on the US Federal Reserve's monetary policy direction, particularly whether interest rates will be cut further to counter inflationary pressures. Such a move could provide breathing room for the local property market and gradually stabilize prices.

In the short term, the impact of new property launches on the secondary market is expected to remain limited. Although the primary market has recently experienced a temporary lull with slower sales activity, secondary property prices still face downward pressure. In many areas, transaction prices have already fallen back to or below levels seen a decade ago.

The market's current focus is on Sun Hung Kai Properties’ largest-ever residential project, located in Sai Sha’s Shap Sze Heung area along Sai Sha Road. This development has drawn significant attention from both the industry and potential buyers. The first phase of the project, "SIERRA SEA," is expected to announce pricing and commence sales as early as next week. The pricing strategy and sales performance of this project are widely regarded as key indicators for the short-term market outlook.

From a regional perspective, this week’s index showed a “two up, two down” trend. The New Territories West region recorded the largest decline of 0.48%, with the latest reading at 111.96 points. This is attributed to the higher concentration of unsold new units in the area, exerting significant downward pressure on prices. Meanwhile, the New Territories East region fell by 0.13%, with the index now at 111 points.

Overall, Hong Kong's property market continues to face significant challenges amid uncertain internal and external conditions. Geopolitical tensions, uncertainty in interest rate policies, and competitive pressure from new property launches all present multiple variables for the market. In the short term, property prices are likely to remain under pressure. However, should favorable policies emerge, the market could gradually regain stability.

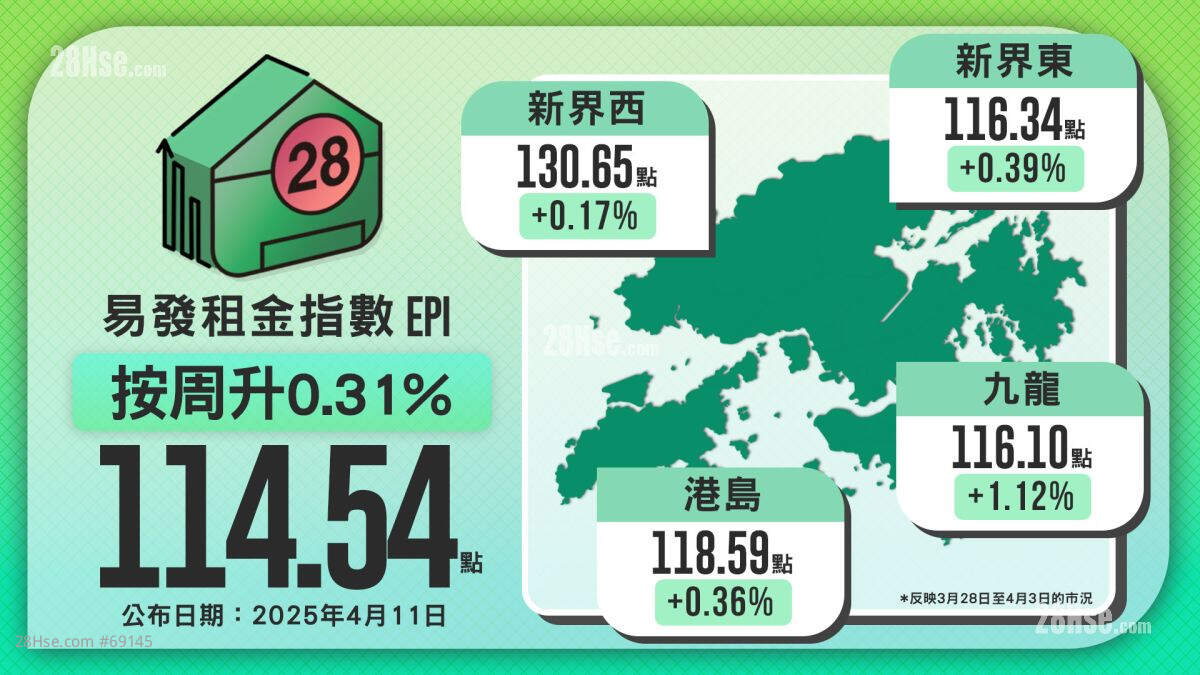

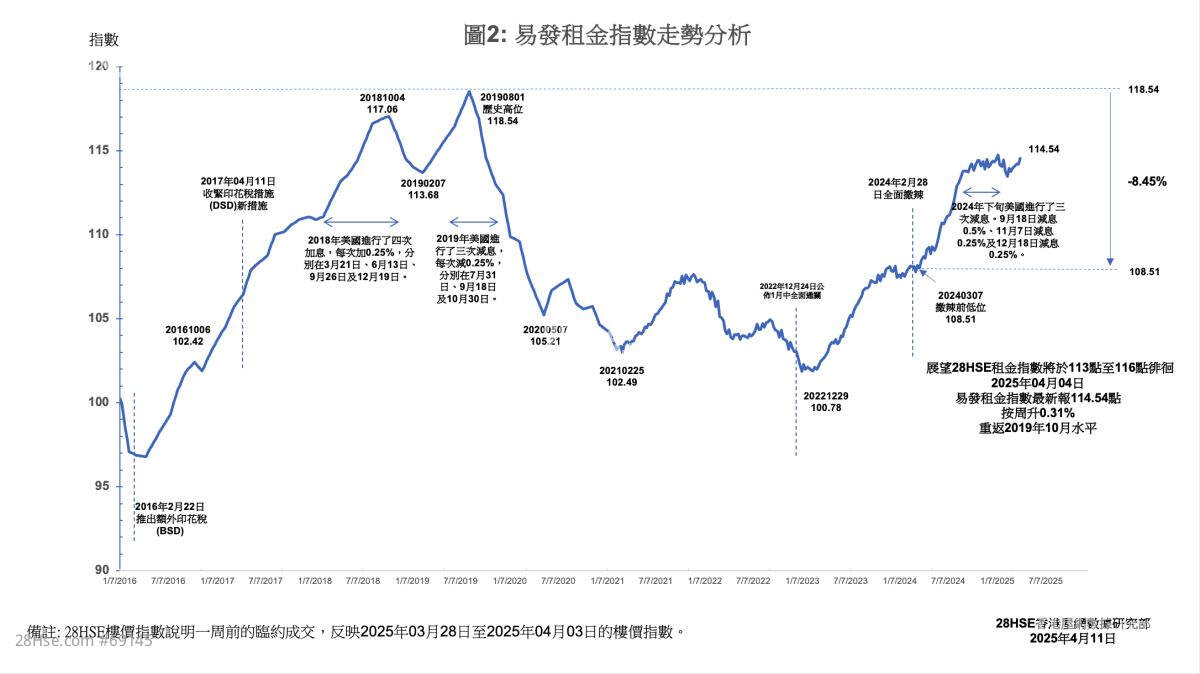

Eva Rental Index Hits Historic High, Up 0.31% Weekly

Despite the decline in property prices, rental demand remains strong. The Eva Rental Index has maintained its historic high, reaching 114.54 points this week, up 0.31% week-on-week. All regional indices recorded increases, with the largest rise seen in Kowloon, where the index climbed 1.12% to 116.1 points. This was followed by the New Territories East region, with an index of 116.34 points, up 0.39%. Hong Kong Island reported 118.59 points, up 0.36%, while the New Territories West region stood at 130.65 points, up 0.17%.

A unit at Two Artlane in Sai Ying Pun recently achieved a record-high rental rate of HK$86 per square foot, marking the highest level this year. This suggests that rental prices are likely to continue trending upward shortly.

Like