- Home

- News

- Property Index

- Hong Kong Property Market Update: Eva Property Price Index Under Pressure Amid New Property Promotions

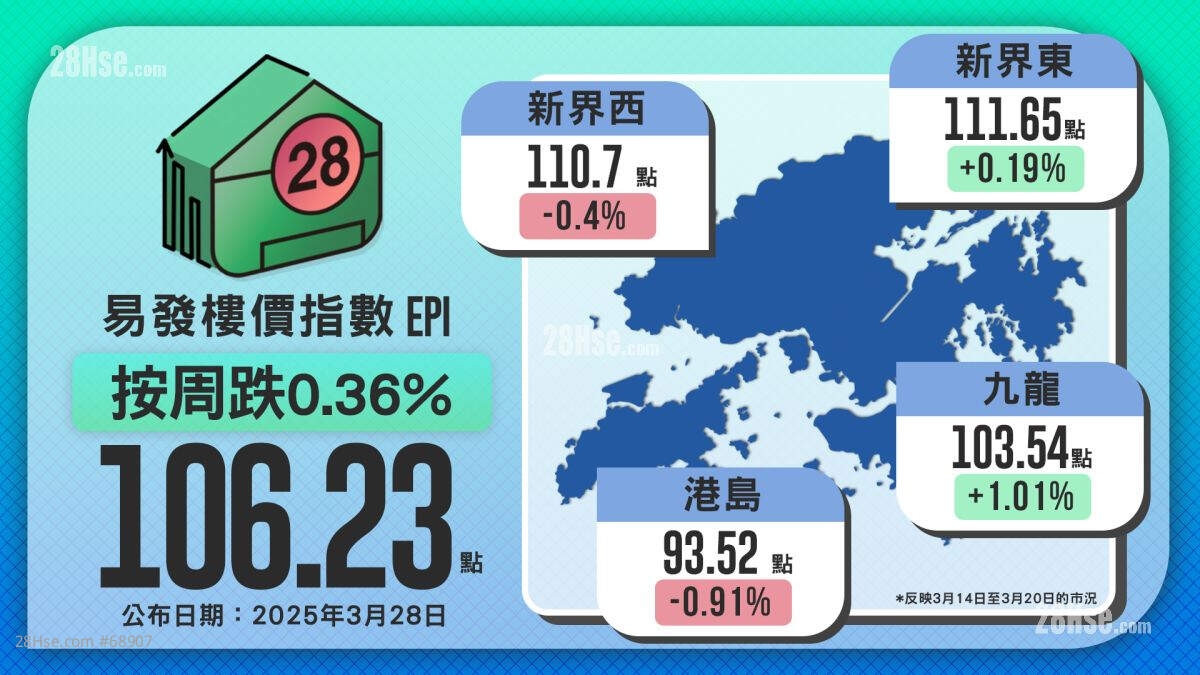

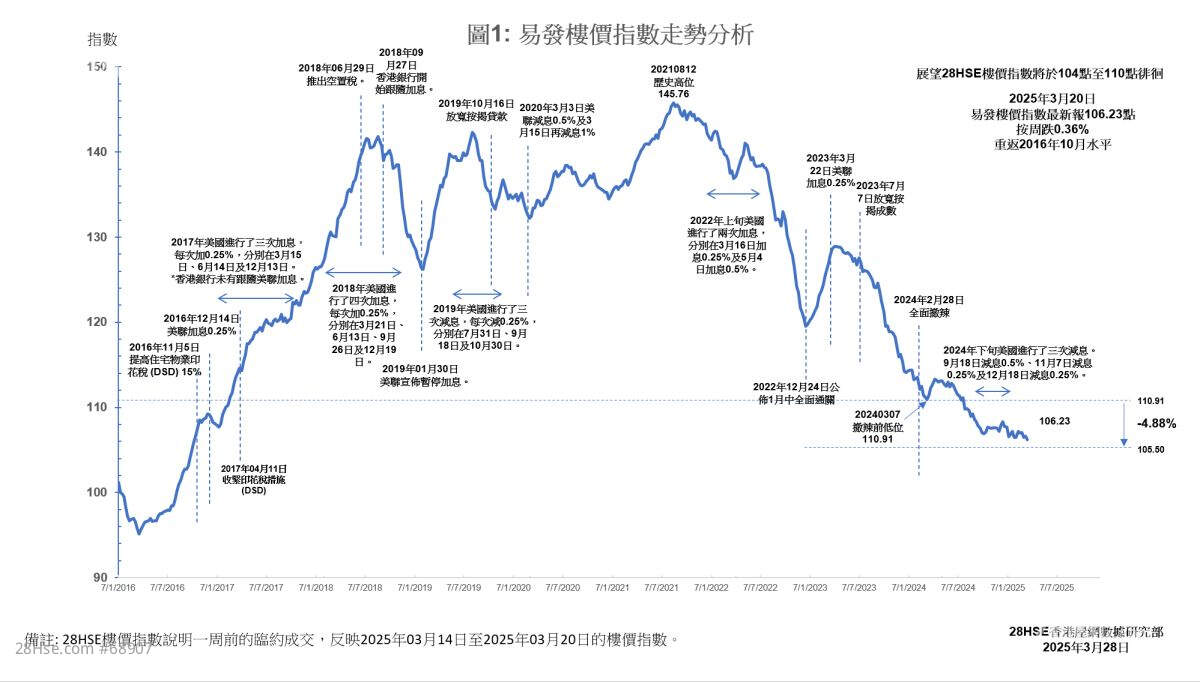

Eva Property Price Index Drops 0.36% Amid Market Competition

The latest EPRC property price index recorded 106.23 points, down 0.36% week-on-week, remaining at levels last seen in October 2016. This reflects continued pressure on the housing market, which has yet to recover from its sluggish state. Developers have recently accelerated the launch of new projects, offering competitive pricing to attract buyers. Among them, "Shang Yin" in Tai Po has drawn market attention by offering an additional small unit for as low as HK$880,000 with the purchase of a larger unit. Meanwhile, YOHO WEST PARKSIDE in Tin Shui Wai continues to sell well, along with other lingering stock from projects such as Grand Seasons in Lohas Park, The Grand in Tuen Mun, and The Vertex in Cheung Sha Wan. This has further squeezed the secondary market, causing second-hand transactions to plummet.

The continuous price cuts in new developments have made it difficult for second-hand property prices to stabilize, exacerbating a wait-and-see sentiment in the resale market. According to real estate agency statistics, mid-month new home sales have already exceeded 1,500 transactions, indicating that most buyers are opting for new homes, leaving the secondary market stagnant. As a result, homeowners looking to sell must also reduce prices. Given the ongoing strong demand for new properties and capital shifting toward the primary market, the price index is expected to decline further this month, keeping the market under short-term adjustment pressure.

Regional Index Shows Mixed Performance

The latest index reveals a "two up, two down" trend across Hong Kong’s four major regions:

Kowloon saw the highest increase, rising 1.01% to 103.54 points, indicating stronger buying interest, possibly fueled by positive sentiment from successful new project sales.

New Territories East also recorded a slight gain of 0.19% to 111.65 points.

Hong Kong Island, however, was the weakest performer, dropping 0.91% to 93.52 points, making it the worst-hit region of the week. This could be due to intensified competition in the second-hand market and some sellers becoming more flexible on pricing.

New Territories West followed a downward trend, falling 0.4% to 110.70 points, suggesting that buying power remains weak, possibly due to economic uncertainties keeping buyers on the sidelines.

Although the government announced a relaxation of the HK$100 stamp duty threshold in the late-February budget to stimulate demand, its short-term impact on the property market remains uncertain. Industry experts believe the future of the market will depend on economic recovery, interest rate trends, and developers' sales strategies, with property prices likely to remain volatile in the short term.

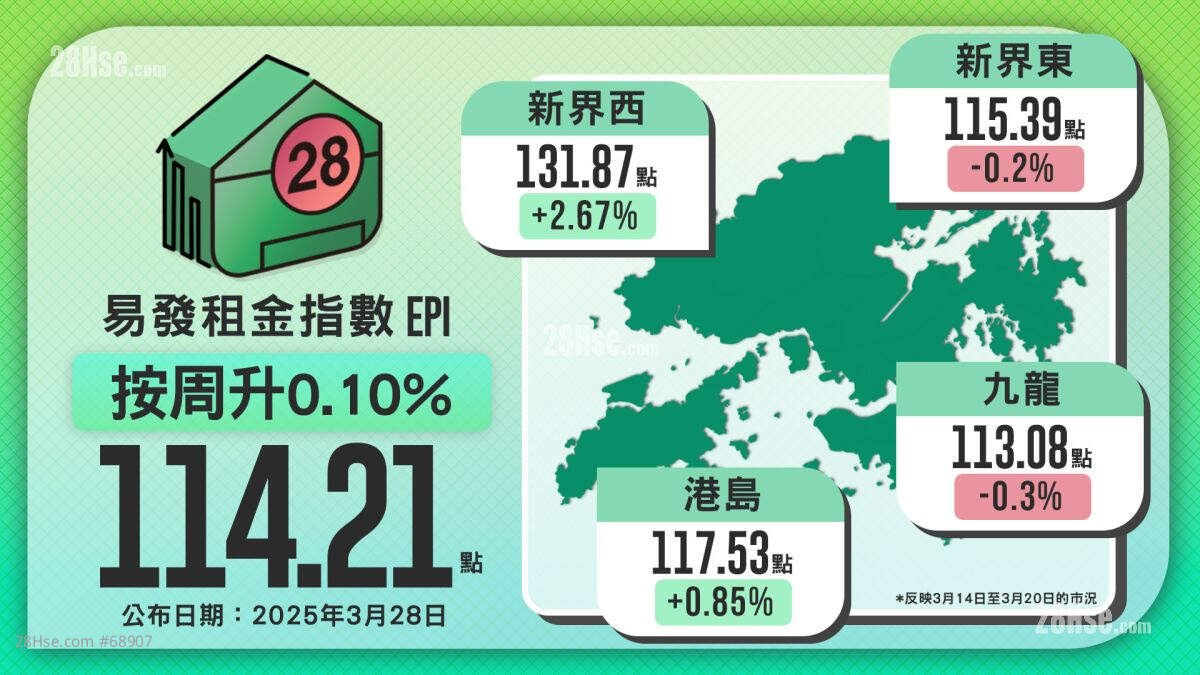

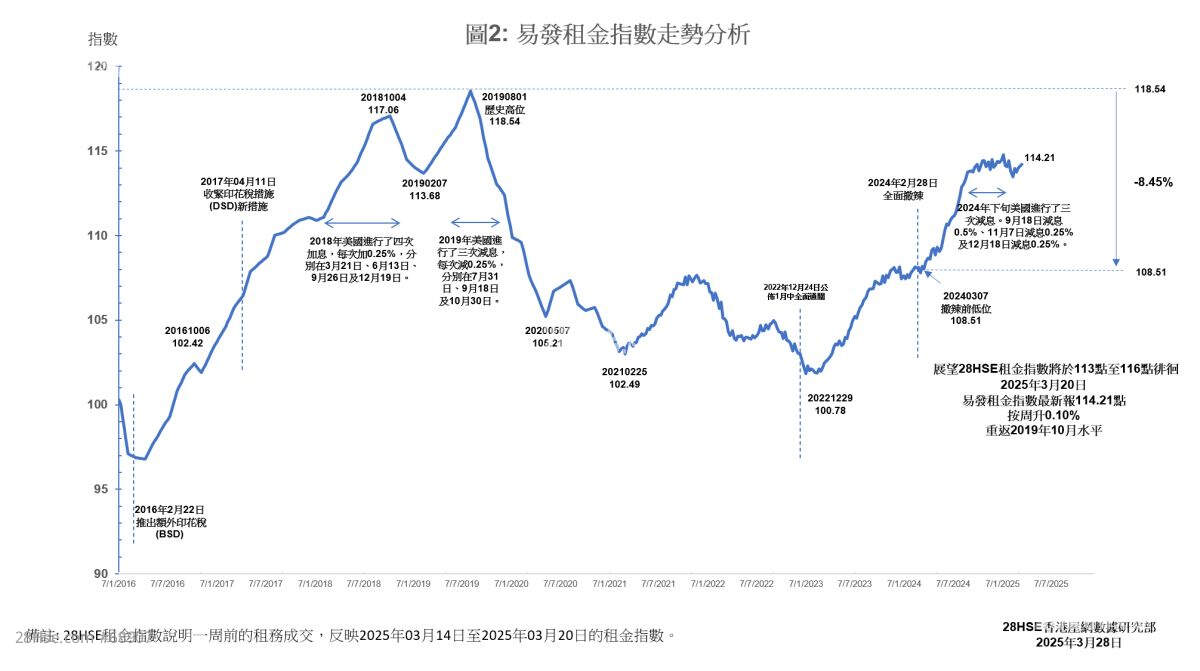

Rental Market Resilient as Index Rises for Second Consecutive Week

The Eva rental index rose for the second straight week, reaching 114.21 points, up 0.10% week-on-week. This indicates resilience in the rental market, as some prospective buyers postpone home purchases and turn to leasing due to high interest rates. The prime rate (P) remains at 5.25%, unchanged for two consecutive reviews, keeping borrowing costs high and sustaining rental demand.

Regional Rental Trends Show Diverging Patterns

New Territories West led the gains, surging 2.67% to 131.87 points, driven by strong demand, possibly from buyers who missed out on new launches opting to rent instead.

Hong Kong Island also saw steady growth, rising 0.85% to 117.53 points, reflecting stable leasing demand in prime areas, particularly among high-end tenants waiting for a better time to buy.

Kowloon, however, saw a slight drop of 0.3% to 113.08 points, likely due to increased supply and tenants relocating to more affordable areas.

New Territories East also declined 0.2% to 115.39 points, suggesting limited rental growth due to new supply and renters opting for more budget-friendly units.

Overall, the rental market remains influenced by interest rates, economic conditions, and homebuying demand. If interest rates stay elevated, more potential buyers may delay their purchases, further supporting rental demand and pushing the rental index higher.

This week's index reflects market conditions from March 14 to March 20, 2025.

Like