- Home

- News

- Property Index

- Eva Property Price Index Stabilizes With A 0.97% Weekly Increase, Still At An 8.5-year Low

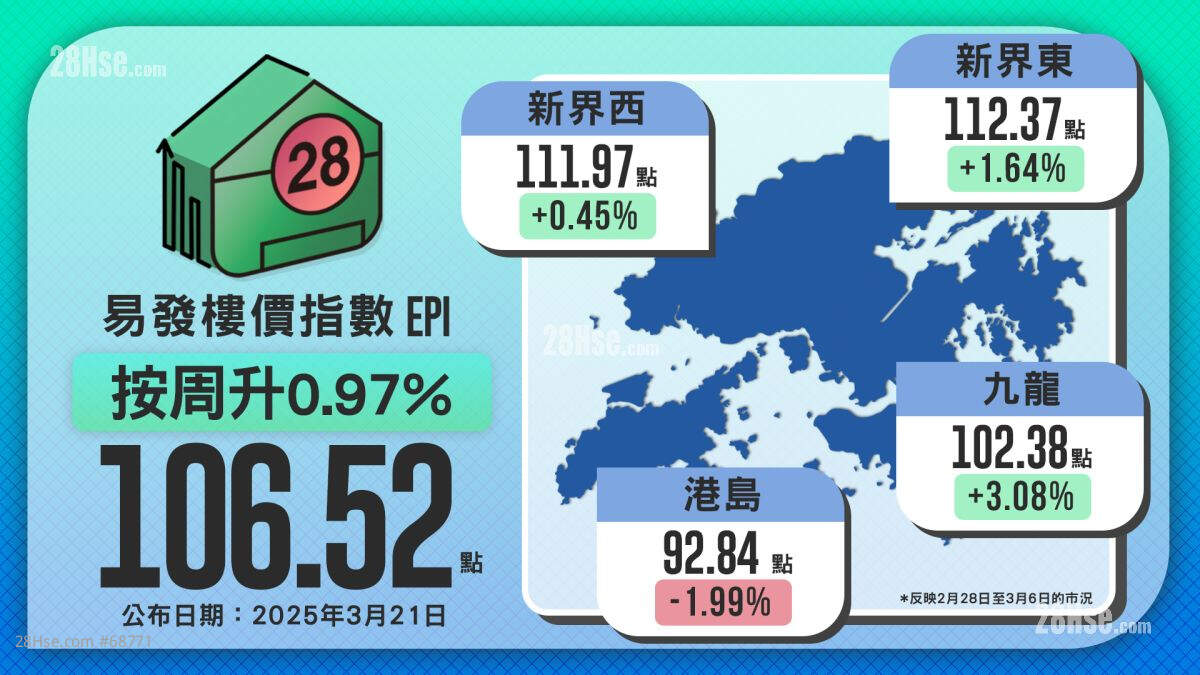

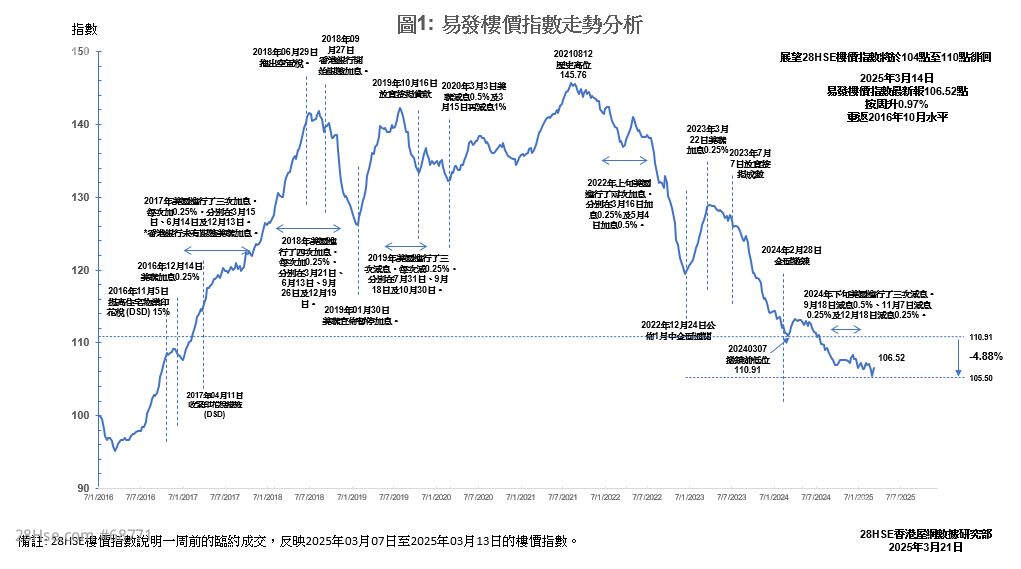

The latest Eva Property Price Index stands at 106.52 points, marking a slight 0.97% weekly increase. However, the index remains at its lowest level in 8.5 years, returning to October 2016 levels. With expectations of positive market developments, Hong Kong’s property market is anticipated to experience a steady recovery.

Recent strong primary market transactions indicate that purchasing power is gradually being released. For example:

YOHO WEST PARKSIDE has sold nearly 500 units after four rounds of sales.

Shang Yuen in Tai Po sold 80% of its units after two rounds of sales.

As a result, potential buyers who missed out on new property launches may soon turn to the secondary market.

Budget Measures Stimulate Buyer Demand

The recent Budget announcement to relax the HK$100 stamp duty threshold is expected to benefit the affordable housing segment. By lowering the cost of entry, first-time buyers and investors are encouraged to enter the market. The positive effects of this policy, coupled with strong primary market sales, have quickly boosted secondary market transactions, further reinforcing the property market’s recovery trend.

Regional Price Index Performance: "Three Up, One Down"

The latest property price index across Hong Kong's four major regions shows a "three up, one down" trend:

Kowloon: The strongest performer, up 3.08% weekly to 102.38 points, benefiting from robust new project sales and increased purchasing power.

New Territories East: Up 1.64% to 112.37 points, supported by attractive new developments and infrastructure growth.

New Territories West: Up 0.45% to 111.97 points, reflecting an active affordable housing market and investor interest.

Hong Kong Island: The only region to decline, down 1.99% to 92.84 points, potentially due to buyer caution in the luxury sector, price adjustments by sellers, and a shift in demand towards more affordable options in Kowloon and the New Territories.

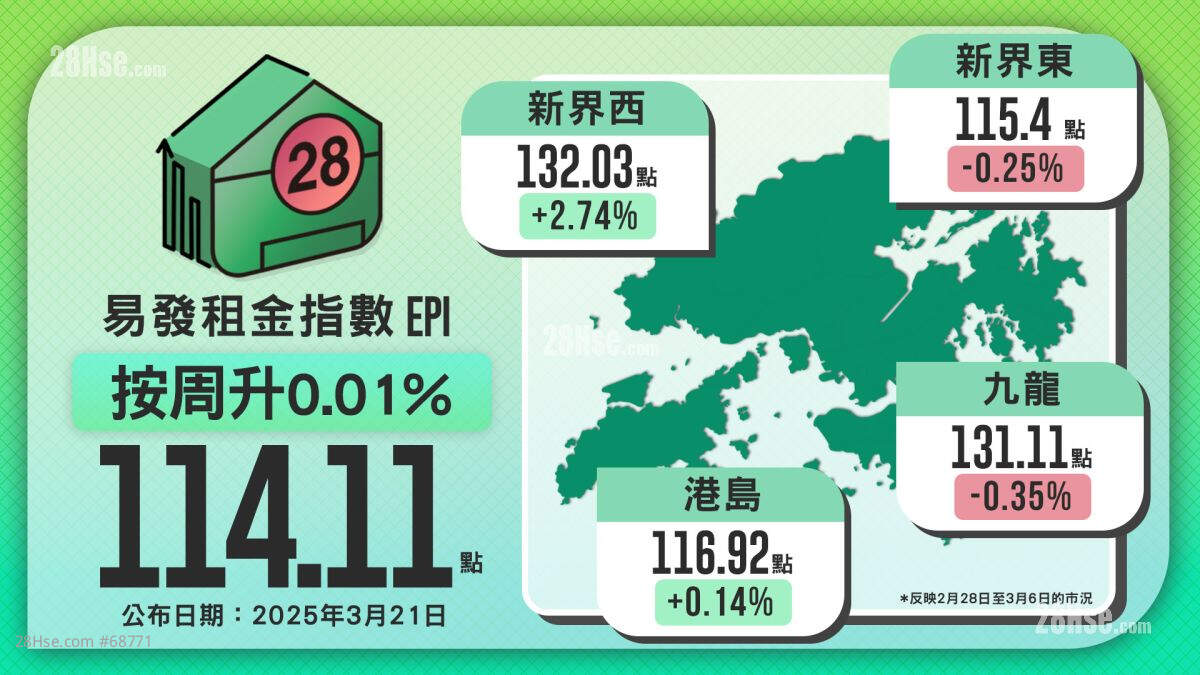

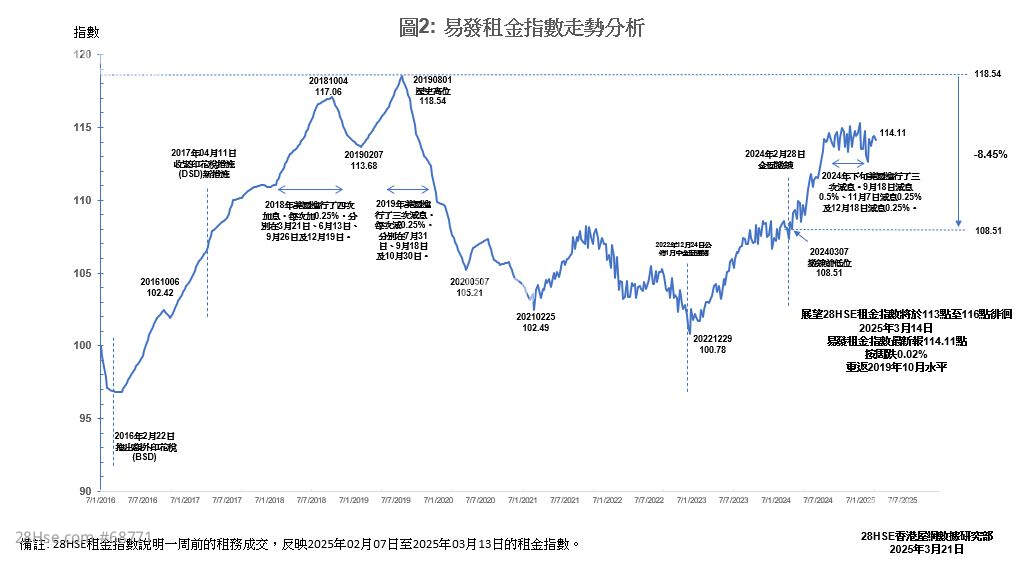

Rental Market: Stable with Narrow Fluctuations

The Eva Rental Index remains stable at 114.11 points, unchanged month-on-month and rising only 0.01% weekly. This suggests that rental prices have stabilized from February to mid-March, with supply and demand largely balanced.

Regional Rental Performance: "Two Up, Two Down"

New Territories West: Biggest increase, up 2.47% weekly to 132.03 points.

Hong Kong Island: Slight increase of 0.14% to 116.92 points, supported by rising rental demand from incoming mainland professionals.

Kowloon: Down 0.35% to 113.11 points, reflecting slower rental demand.

New Territories East: Down 0.25% to 115.40 points, likely due to seasonal effects, as early in the year is typically a slower rental period.

With rental prices stabilizing and property prices showing signs of recovery, the short-term rental market is expected to remain steady. However, future trends will depend on factors such as market demand, economic conditions, and interest rate movements.

This week's index reflects market conditions from March 7 to March 13, 2025.

Like