- Home

- News

- Transaction

- Customs Clearance Effect Luxury Housing Market First Benefited More Than 50 Million Yuan New Building Transactions Are Expected To Double And Prices Will Rise By 20%

The mainland and Hong Kong have resumed normal customs clearance, looking forward to the "North Water and South Chung", and luxury houses and retail markets are the first to benefit. Sales of new luxury houses exceeding 50 million yuan have picked up in the first half of the month, reaching a 13-month high. The real estate industry expects that this year’s transactions of first-hand and second-hand luxury houses exceeding RMB 50 million will increase by 2 times to 350 and by more than 40% to 300; %. At the same time, it is expected that the cost of shops in the core area will also increase by 20% throughout the year, and the rent will increase by 20% or more. The shops in Tsim Sha Tsui and Mong Kok will benefit the most. ◆reporter Liang Yueqin

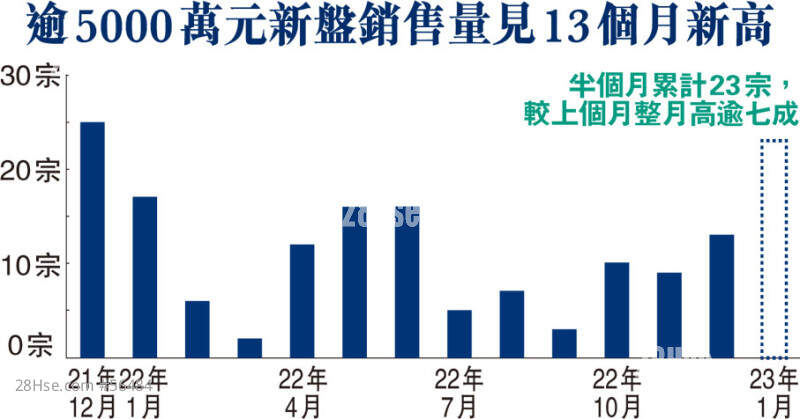

As the mainland and Hong Kong resume customs clearance in an orderly manner, interest rate hikes are expected to slow down, and the investment climate is getting better, which will become the driving force for luxury housing. According to the data from the first-hand residential property sales information website, in January (as of the 15th), there were 23 sales of new properties exceeding 50 million yuan, which was about 77% higher than the 13 sales in the whole of last month, and hit a 13-month high. It fully reflects the recovery in the sales of new luxury properties.

Looking forward to releasing the purchasing power of mainland customers

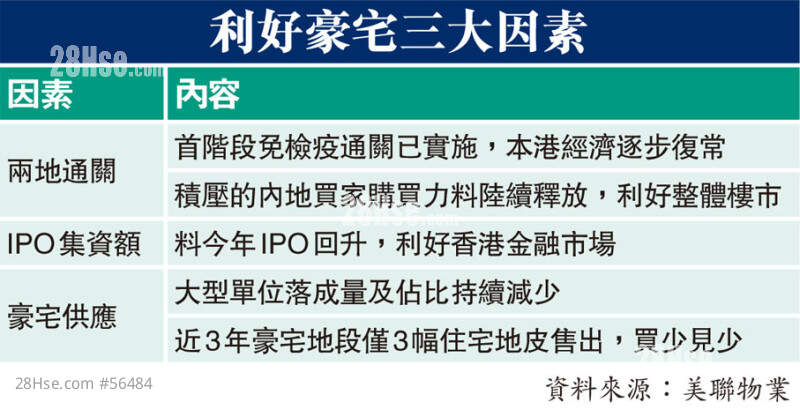

Bu Shaoming, Chief Executive Officer (Hong Kong and Macau) of the Residential Department of Midland Real Estate, said yesterday that there are many factors that are positive for the luxury housing market in the near future, including the return of customs clearance between the Mainland and Hong Kong, the dawn of Hong Kong’s economic outlook, which is good for the financial market, and the shortage of luxury housing supply. First of all, affected by the epidemic in the past three years, there are very few tourists visiting Hong Kong, which has dealt a major blow to the property market, retail, tourism and hotel industries in Hong Kong. However, the first phase of quarantine-free customs clearance between the Mainland and Hong Kong was officially implemented at the beginning of the month. According to the Immigration Department, the number of visitors entering Hong Kong from the Mainland has soared recently. It is believed that the Hong Kong economy will gradually return to normal, and it will also boost the sentiment of the property market. further improvement. Since it was difficult for mainland buyers to come to Hong Kong in the past three years, it will inevitably affect their desire to buy property. Therefore, "clearing the customs" will help release the purchasing power of the backlog of mainland buyers in Hong Kong's property market, which will benefit the overall property market and even luxury housing performance.

In addition, with the dawn of Hong Kong's economic outlook, it is believed that this year's initial public offering (IPO) fundraising in Hong Kong is expected to pick up. Based on the forecasts of the four major accounting firms, the annual amount will reach 180 billion to 230 billion yuan, compared with 104.6 billion yuan in 2022 The large increase of more than 70% to 1.2 times has benefited the Hong Kong financial market, which in turn stimulated the property market and luxury housing trading atmosphere.

Tight Supply Supports Luxury Home Performance

On the supply side, there is a shortage of luxury homes. According to the data from the Rating and Valuation Department, in recent years, the proportion of completions of large units (Class E units, with an area of 1,722 square feet or more) has continued to decrease. From 2008 to 2010, it accounted for 5.5% of the total completions. 1.8% in the first 11 months of 2022, the decline will help support the performance of luxury residential property prices.

In addition to the decline in the proportion of luxury housing completions, the supply of related land is also scarce, which is also an important factor supporting the market outlook. According to the data from the Lands Department, in the past three years, only 3 pieces of residential official land have been successfully sold in luxury residential areas, namely the Repulse Bay Nanwan Road land sold for 1.188 billion in February 2022,In February 2021, the lands at Nos. 9 and 11, Man Fai Road on the Peak were sold for 7.25 billion yuan, and the lands at Nos. 2, 4, 6 and 8, Man Fai Road on the Peak were sold for 12 billion yuan in December 2020, reflecting that the related supply is rare .

Interest rate hike is expected to peak favorable atmosphere

Bu Shaoming concluded that when the market enters 2023, there will be many good news, including the relaxation of epidemic prevention measures in the Mainland, and the return of customs clearance with Hong Kong, which will make a big step forward in the return of Hong Kong's economy and property market, especially for the luxury housing market. effect. In addition, the US interest rate hike cycle is expected to peak in the first half of the year, which will help improve the overall property market sentiment. Coupled with the fact that owners of luxury homes generally have strong holding capacity and are reluctant to sell them, combined with the above-mentioned factors such as the shortage of supply of luxury homes, the resilience of luxury homes is more advantageous than that of ordinary homes.

He believes that this year’s luxury housing market will be on the high end, and the first-hand transaction volume of more than 50 million yuan is expected to double from 116 in 2022 to an estimated 350 this year. During the same period, the number of second-hand housing registrations exceeding 50 million yuan is expected to rebound by more than 40%, from 212 in 2022 to an estimated 300 this year. It is also estimated that the overall price of luxury housing is expected to rise by 15% to 20%, outperforming the market.

Like